The trade barriers that made the import of Marks & Spencer’s Percy Pig sweets one of the first casualties of Brexit has added an extra £600m in costs to British importers since January, it has emerged.

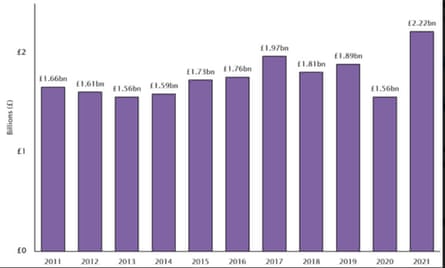

Customs duties paid by UK businesses shot up from £1.6bn in the first half last year to a record £2.2bn in the same period this year, according to an analysis of HMRC data.

Percy Pig sweets were among 2,000 food product lines that were hit by “rules of origin” regulations that came into force with the Brexit trade deal on 1 January.

In January M&S raised the prospect of Percy Pigs being subject to tariffs in Northern Ireland because of the rules of origin. Although manufactured in Germany, they were first brought to the UK before being re-exported to Ireland – a journey that would now be subject to import taxes because the tariff exemption in the trade fell away as soon as they were re exported.

The scale of the impact of these complicated rules on importers is only emerging now and gives the lie to the notion that a free trade deal is cost-free to business.

Since then thousands of businesses have found they have to pay taxes if the product they are importing under the trade and cooperation deal is not sufficiently manufactured in the EU.

Trade bodies are reporting that some companies find the rules so complicated that they end up just paying the customs duties for ease of trading.

Michelle Dale, senior manager at accountancy firm UHY Hacker Young, said: “UK businesses weren’t given enough time or help to prepare for the cost of Brexit or the masses of paperwork.

“The result is that the cost of tariffs and extra paperwork is now causing serious difficulties for many businesses who are already struggling to stay profitable in the face of mounting pandemic-induced costs.”

The rise in customs duties paid is directly attributed to Brexit, as they were not payable on goods imported from the EU while Britain was in the single market.

Under the trade deal, goods that are majority made or processed in the EU can be imported without customs duties, with slight variations depending on the product.

“The Percy Pig issue is still an issue more than eight months on for importers. Across the board, companies are still having difficulties getting to grips with rules of origin,” said William Bain, the head of trade policy at the British Chamber of Commerce.

“If the exporter cannot provide a certificate of origin, then importers may not be able to provide sufficient proof over the origin of the product, and some are then saying it’s just easier to pay the tariff,” he added.

Fergus McReynolds, the director of EU and international affairs at Make UK, which represents the manufacturers, said businesses are still grappling with rules of origin and what import duties are payable on.

“We didn’t actually see the black and white of the text until Christmas Eve, and that didn’t give companies a lot of time to understand the implications,” he said.

“There is some anecdotal evidence that some companies have found the process difficult and in order to continue trading they are taking the option of paying the tariffs for ease of trading,” he added.

The rules of origin do not apply only to raw materials but also to products that are modified in an EU country and contain ingredients or components from outside the EU.

“If it is not deemed to be sufficiently processed in that country then they may not comply with the rules of origin,” said McFergus.

Manufacturing Northern Ireland has also identified difficulties for local traders importing from the UK.

Earlier this year, Stephen Kelly, the chief executive of the trade body, told a select committee of an automotive company that was buying axles from a German supplier.

Under the special arrangements for Northern Ireland, which is observing EU rules, tariffs should not have applied to that trade. However, because the axle was first sent to Britain for modification, the rules of origin exemptions did not apply.