A vote to leave the European Union would trigger economic and political convulsions in the UK, plunging the country back into recession and sending the pound sharply lower, a forecasting group has warned.

Investors would rush to dump UK assets including shares and bonds in the immediate aftermath of voters choosing Brexit, according to the Economist Intelligence Unit.

The pound would fall 14-15% against the dollar in the course of this year, unemployment would rise and the UK would risk losing its status as a global financial centre.

In its Out and Down: mapping the impact of Brexit report, the EIU warned the damage from a decision to leave the EU would be felt until at least 2020.

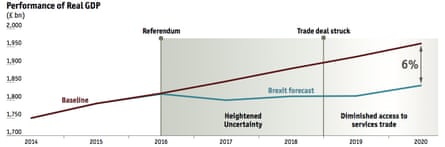

Analysts at the thinktank claim the UK economy would shrink 1% next year in the event of Britain voting to leave in the 23 June referendum. That would be the first contraction in annual GDP since the depths of the financial crisis in 2009.

By 2020, the economy would be 6%, or £106bn, smaller than it would have been had it stayed in the EU, as the UK grappled with a “highly disruptive period in the country’s history”, the EIU said.

Danielle Haralambous, UK analyst at the EIU, said: “While some of the remain campaign claims may seem alarmist, the fact is that a vote to leave would have a negative political and economic impact.

“The negotiation process would create a period of uncertainty, both for consumers and investors, sterling would weaken and prices would rise, especially as trading with European counterparts became more complex.”

The thinktank’s damning report on the consequences of Brexit predicted consumers would spend less and companies would delay investment decisions in a climate of heightened uncertainty over Britain’s economic future.

That in turn would be a drag on GDP and contribute to a rise in unemployment, peaking at 6% in 2018. The number of people out of work would be 380,000 higher than if the UK voted to stay, the EIU said.

Borrowing costs would rise, as the average yield on 10-year government bonds would be 0.6 percentage points higher in the second half of 2016 than they would have been inside the EU, reflecting the additional risks associated with UK assets.

“Should the UK vote to leave the EU on 23 June, the country’s economy will be plunged into uncertainty. This would be reflected in the first instance by tumultuous financial market volatility, but there would also be a swift impact on the real economy, with households and businesses reining in their spending until the dust settles,” the EIU said.

Some parts of the economy would feel the negative effects of Brexit more than others, according to the report:

- Financial services London’s status as a global financial hub would be at risk and the sector would shrink. Firms would move operations out of the UK to ensure access to the single market, benefiting other European centres such as Frankfurt and Paris.

- Retail Brexit would deliver a “short and relatively sharp” retail shock, with sales volumes falling 3% in 2017 and growth not stabilising until 2020. Companies in the sector would struggle with more complex supply chains and prices would rise as a weaker pound would make imports more expensive.

- Car industry A UK recession in 2017 would lead to a fall in car sales over the next few years. However, Brexit could have some advantages for the industry, with increased trade barriers potentially benefiting UK-based carmakers and making it harder for say, Volkswagen, to sell in the UK.

- Healthcare Pharmaceuticals exports could be hit unless the UK managed a quick renegotiation of trade links in the event of Brexit. The industry would face uncertainty over regulation, which could deter foreign companies from launching products in the UK market. NHS spending could be cut as recession takes hold, hitting pharma companies.

- Energy Brexit would create uncertainty about the future of the UK energy market. “Post-Brexit, the greater the isolation of the UK from European energy policy and regulatory frameworks, the smaller its influence over the rules governing a market on which it is becoming increasingly dependent.”

- Telecommunications The telecoms industry would be less affected than other industries, mainly because consumers deal with operators at a national level. The biggest impact would be on roaming charges, which are scheduled to be abolished within the EU in 2017. Outside the EU, the UK would have to negotiate a number of commercial agreements to abolish the charge, or to secure lower roaming charges for UK customers in Europe.

Away from the economic implications, the EIU warned: “A vote to leave the EU would trigger a political and constitutional crisis with immediate and lasting impact. It would be an event of immense force, pulling all other considerations into its orbit until the terms of the Brexit agreement have been negotiated.”

Comments (…)

Sign in or create your Guardian account to join the discussion